We Go Live In

What is QuixMTD?

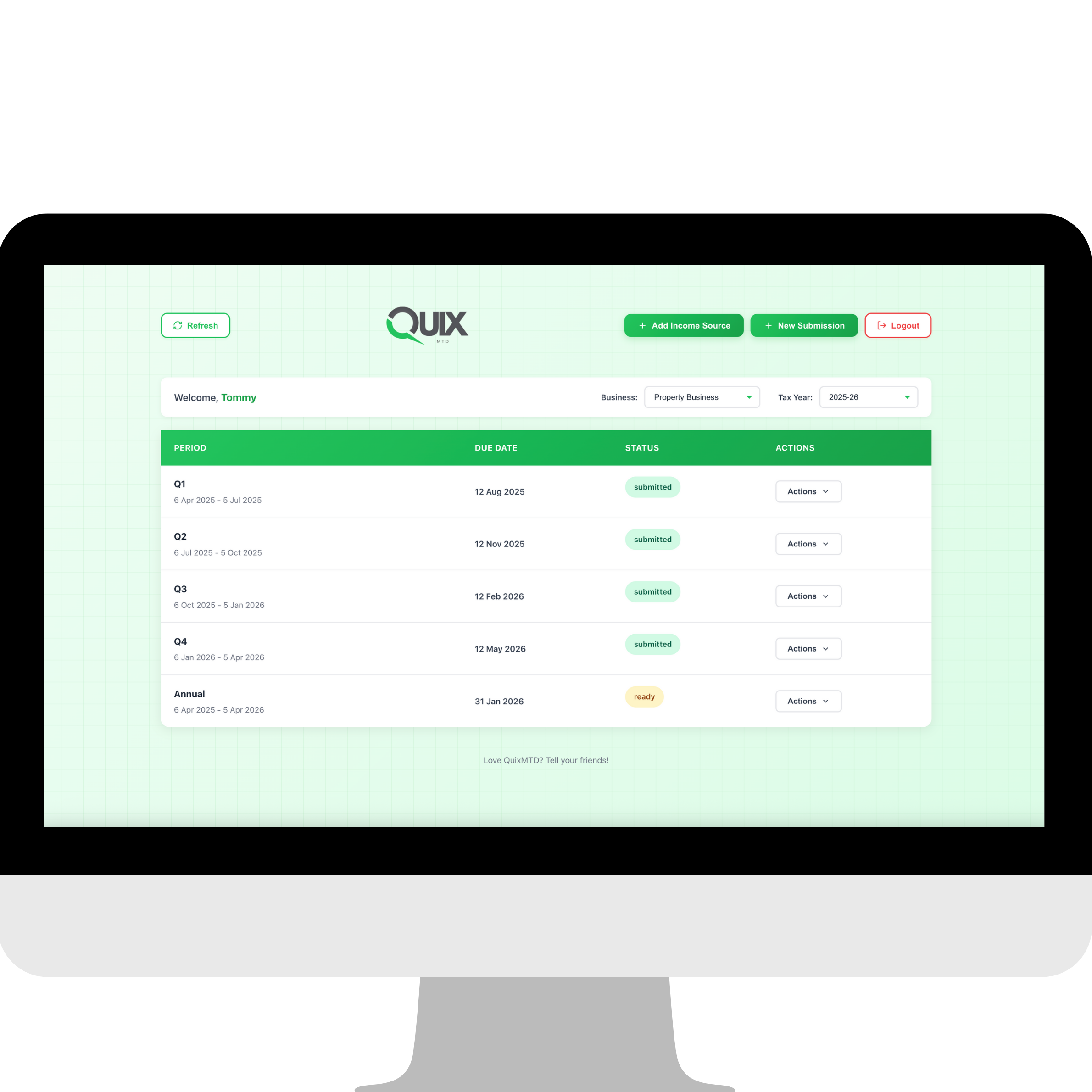

As Making Tax Digital (MTD) rolls out, landlords and sole traders across the UK will be required to keep digital records and submit quarterly updates to HMRC. For anyone currently using spreadsheets to track their finances, that workflow is at risk — unless it becomes compliant.

That's where QuixMTD comes in.

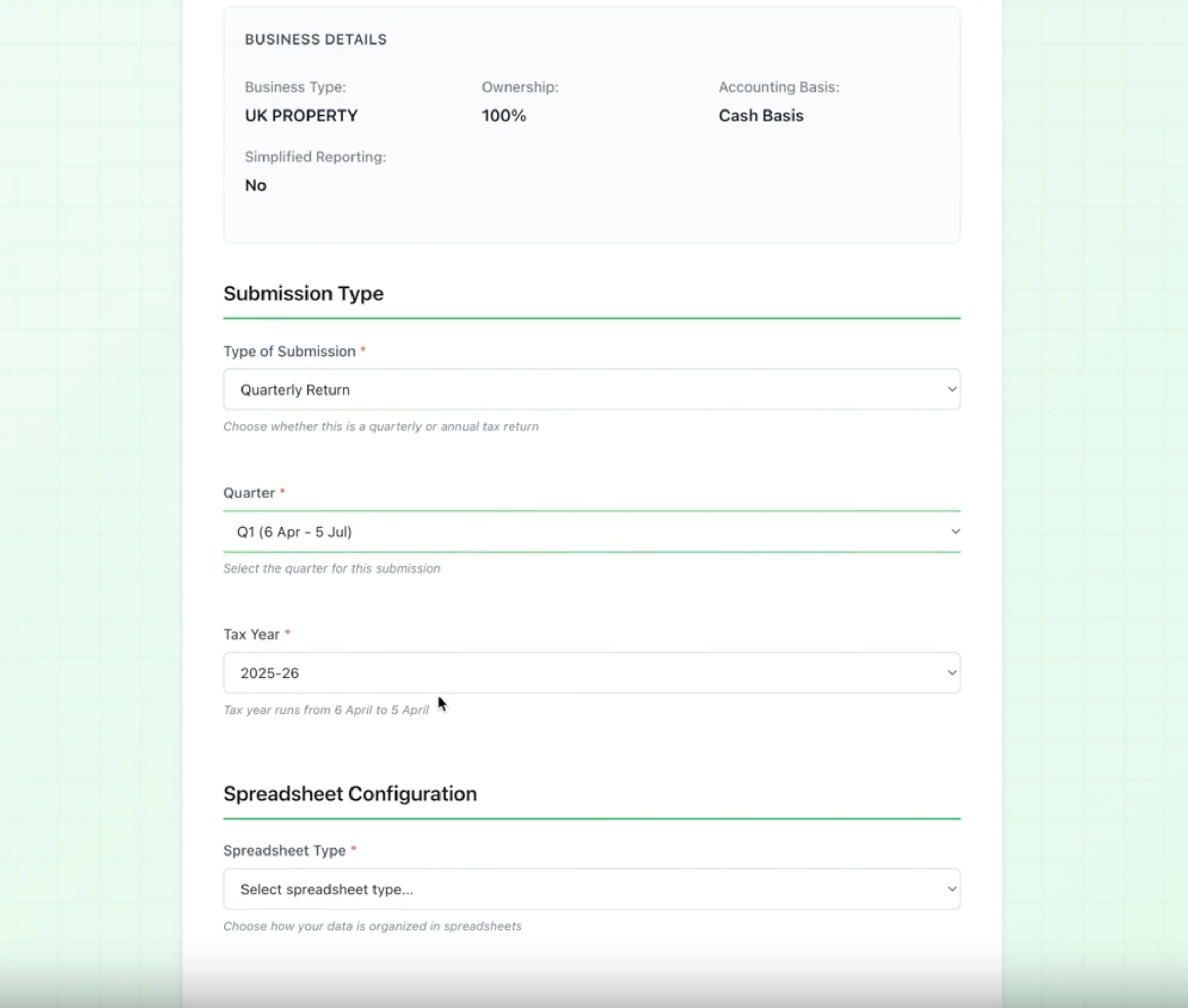

QuixMTD transforms your existing spreadsheets into a fully HMRC-compliant workflow. Just upload your spreadsheet and let the system do the heavy lifting. In seconds, your data is processed, categorised according to HMRC's rules, and ready for review and submission.

- Keep using your spreadsheets - zero workflow changes

- Upload and get HMRC-ready returns in seconds

- Automatic categorisation according to HMRC rules

- Review and submit quarterly updates easily

See Quix in Action

Watch how easy it is to make your spreadsheets MTD compliant

Proudly Partnered with

Simple, transparent pricing

One plan with everything you need

Monthly

per month

Annual

per year

30 day money back guarantee - no questions asked

Frequently Asked Questions

Everything you need to know about QuixMTD